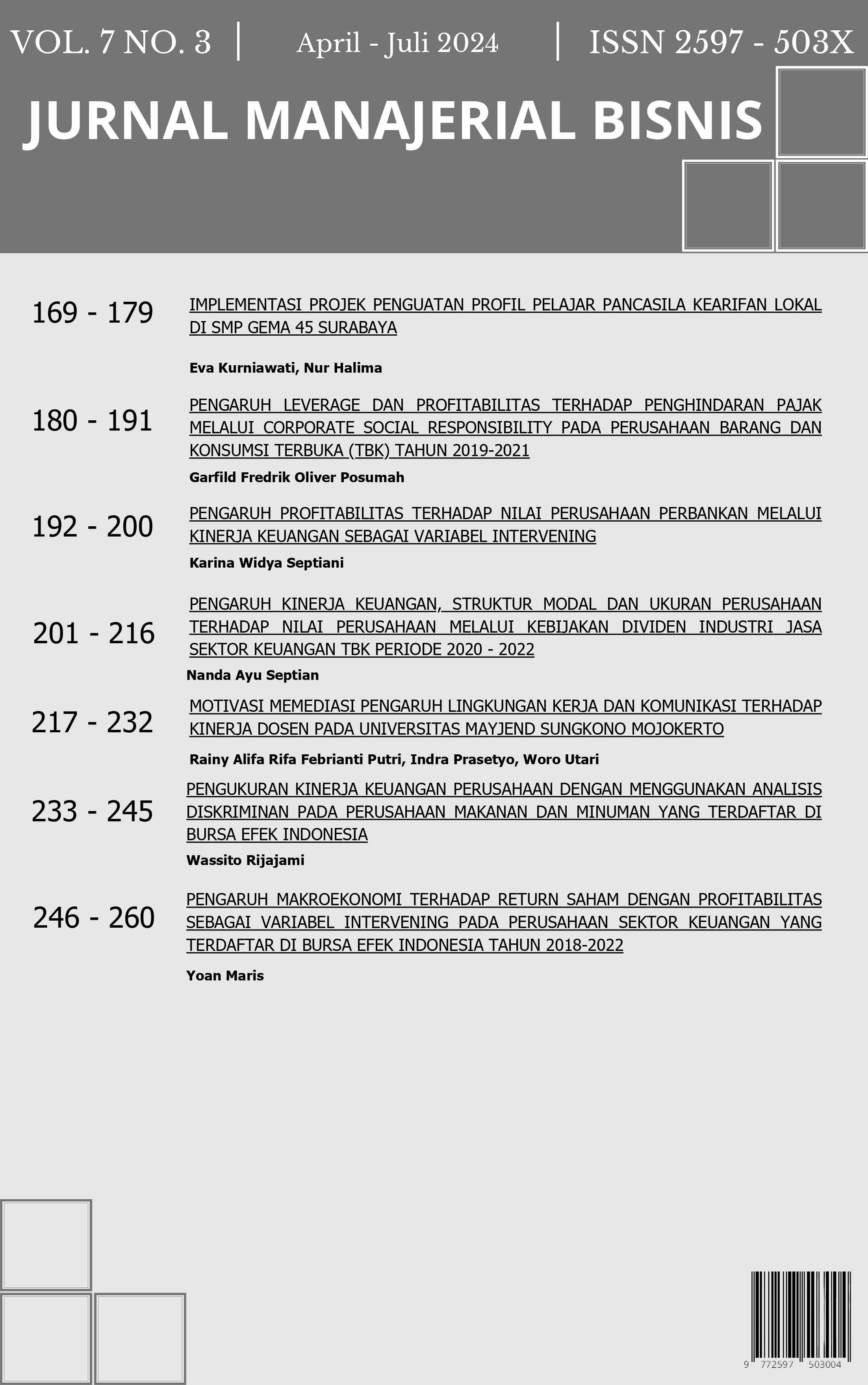

PENGARUH PROFITABILITAS TERHADAP NILAI PERUSAHAAN PERBANKAN MELALUI KINERJA KEUANGAN SEBAGAI VARIABEL INTERVENING

Abstract

This study aims to test and analyze the effect ROA, ROE and EPS on banking company value with company financial performance as an intervening variable. The unit of analysis in this study is a banking stocks listed on the LQ45 index in 2018-2022 as many as 5 companies. Samples were taken using purposive sampling. Data analysis was carried out using the SmartPLS version 3.0 program and data collection through secondary data. Based on the results of data analysis, it is known that ROA significantly has a positive effect on financial performance. ROA has a negative effect on firm value. ROE has a positive effect on financial performance. ROE significantly has a negative effect on firm value EPS has a negative effect on financial performance. EPS significantly has a negative effect on firm value. Financial performance significantly has a positive effect on firm value. Financial performance mediates the effect of ROA on firm value positively and significantly. Financial performance mediates the effect of ROE on firm value positively. Financial performance mediates the effect of EPS on firm value negatively.