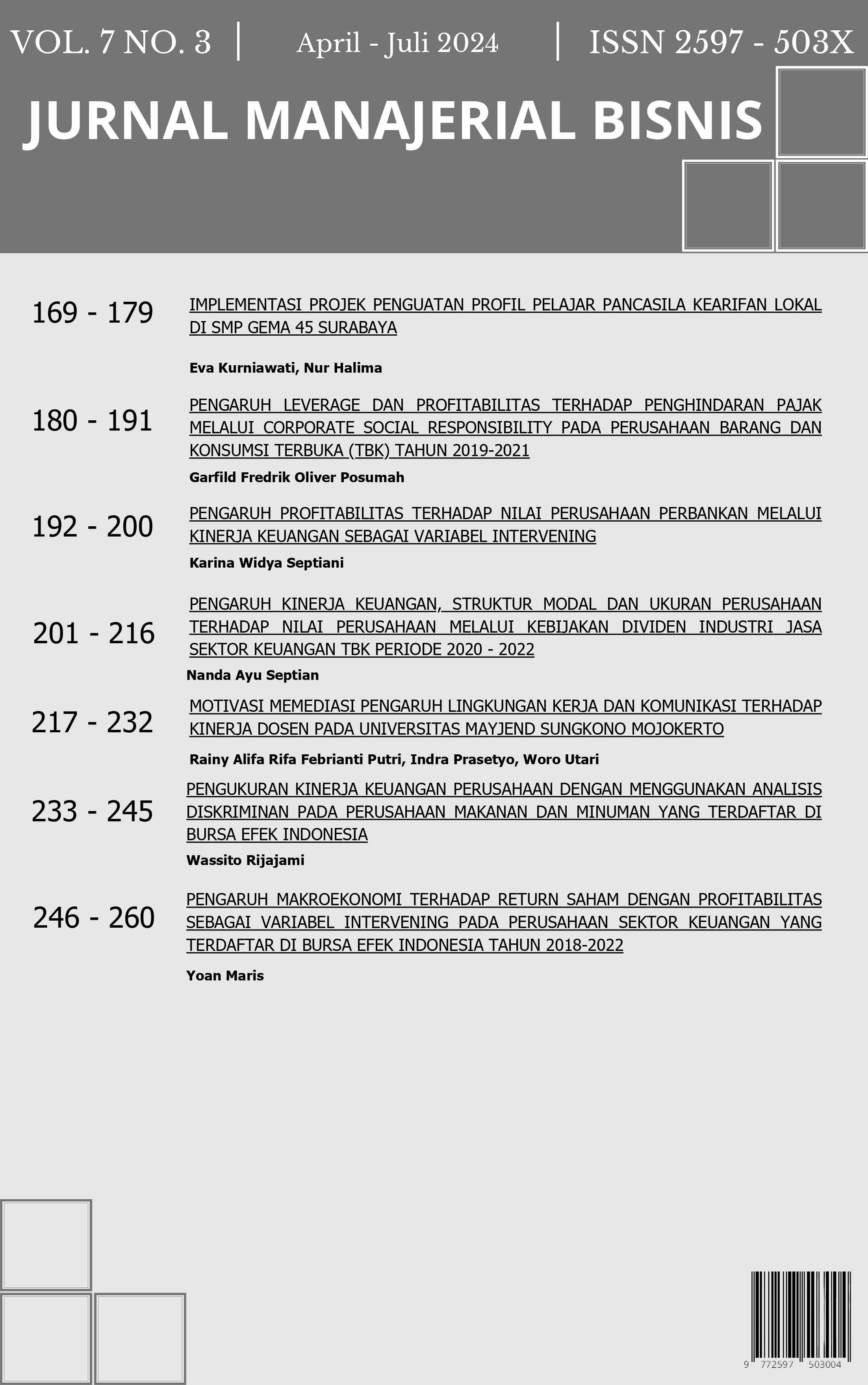

PENGARUH MAKROEKONOMI TERHADAP RETURN SAHAM DENGAN PROFITABILITAS SEBAGAI VARIABEL INTERVENING PADA PERUSAHAAN SEKTOR KEUANGAN YANG TERDAFTAR DI BURSA EFEK INDONESIA TAHUN 2018-2022

Abstract

This study aims to examine and analyze the effect of inflation, exchange rates and interest rates on stock returns with profitability as the intervening variable. This research uses quantitative methods. Sample data collection used a saturated or census sampling method and obtained 55 financial sector companies for the 2018-2022 reporting period. The research results obtained are that inflation has no significant effect on profitability, exchange rate has no significant effect on profitability. Interest rates have no significant effect on profitability. Inflation has a significant effect on stock returns, exchange rate has no significant effect on stock returns, interest rates have no significant effect on stock returns, inflation has no significant effect on stock returns through profitability as an intervening variable, exchange rate has no significant effect on stock returns through profitability as an intervening variable, interest rates have no significant effect on stock returns through profitability as an intervening variable.